Navigating the world of superannuation claims can feel like completing a puzzle. Imagine each step as a piece that, when aligned, forms a clear picture of success. However, without the right guidance and a clear understanding of the end goal, following the Total and Permanent Disability (TPD) claims process is not an easy task, especially when you’ve encountered a life-altering injury or illness.

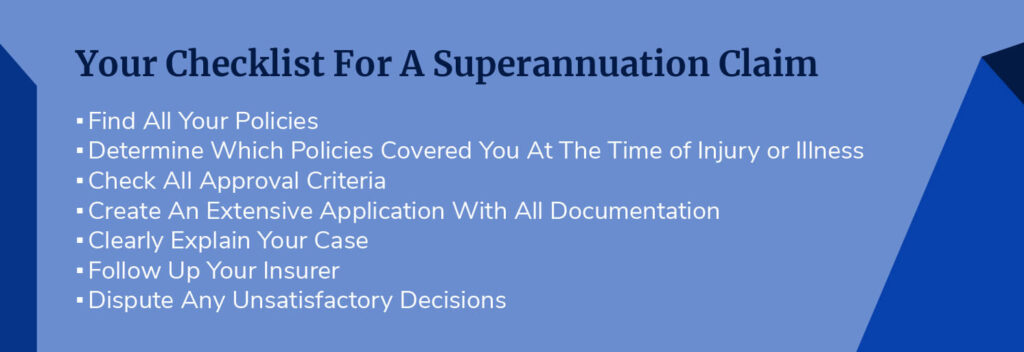

To make things a little easier, we’ve broken down the process into a helpful 7-step checklist to guide you through the superannuation claims process. By following these steps and securing the advice of an experienced superannuation lawyer, you’ll be well on your way to a positive outcome. Let’s dive in and turn complexity into clarity.

Step 1: Locate All Your Policies

To kickstart the process, you’ll need to identify each of your TPD policies. Many people have several of these financial safety nets in place as a result of having a number of different jobs over their careers, so it’s important to identify every policy that you have been covered under. If you have multiple TPD policies, you may be able to make multiple claims.

You’ll need to find your member statements because these important documents detail the insurance coverage that is offered within each fund. A superannuation lawyer can help you with this process from the outset because if you’re unable to find your member statements, they can directly contact the super fund and discover exactly what you’re entitled to.

Step 2: Validate Your Policies’ Active Period

While you might have been covered under one or even multiple policies, it’s important to remember that these policies are only eligible for a specified period. Before you proceed to make a claim, you’ll need to look for the active policy date and then check whether the onset of your injury or illness occurred within this period. If these dates align, you can proceed with the claim.

However, if your injury or illness occurred outside of the specified dates, you may not be entitled to the coverage outlined in the policy. If you’re unsure of these dates or cannot interpret the relevant policy exclusions or fine print, voice these concerns with your superannuation lawyers. With their expertise and experience, they can simplify the process for you to ensure you understand each of its elements. They can also help you secure the most suitable evidence to prove your injury or illness occurred within the period, which will strengthen your case.

Step 3: Deep Dive into Approval Criteria

Now that you’ve found which policies you’re covered under, it’s time to closely look through the terms of the policy to see whether you might qualify for a lump sum payment. No two TPD policies are the same, and some are highly specific to an occupation or industry. This means that the specific instances that quality for a lump sum payment may not align with all cases, or alternatively, different levels of coverage may apply to different circumstances.

For example, the policy might offer different levels of coverage to people who are unlikely to return to work in the same job compared to people who are unlikely to return to work in any job. No two policies are exactly alike, so be sure to work with your superannuation lawyer to discover the intricacies of your policy.

Step 4: Craft a Comprehensive Application

Once you’ve developed a thorough understanding of your unique policy and know what to expect, you’ve reached the most crucial part of the process. Submitting your superannuation claim is not an easy process, and it’s always best when completed alongside a superannuation expert with experience in the process. While many people believe it to simply be a matter of filling out forms, this process can quickly become complex.

Failing to properly submit every single piece of evidence that is required can create major obstacles in the process. Continual back and forth with insurance companies can occur to secure a properly completed medical report or employer’s testimony, dragging out the process and keeping you from receiving the support you may be entitled to. Take your time and do your due diligence alongside your trusted superannuation lawyer to ensure you pave the way to a seamless process.

Step 5: Articulate Your Case Clearly

A crucial component of all well-presented and successful TPD claims is a well-written submission that clearly and precisely explains the situation early on. Your task in this submission is to explain exactly how and why your situation satisfies the relevant criteria from the policy. While many people can write clearly, the most experienced superannuation claim specialists know exactly the type of detail and clarity that insurers and looking for, and their expertise gives you the best chance of putting forth a clear case. A carefully constructed submission makes it clear to the insurer that a professional is on the case, making it easier for them to easier and simpler for them to determine the outcome and resolve your case.

Step 6: Proactively Engage Your Insurer

When it comes to TPD claims, delays can unfortunately be common. However, to ensure your claim comes to a swift and accurate resolution, you should proactively reach out to your insurer and check on the status of your claim. The insurer may not inform you immediately of any issues with your claim or changes required in your evidence, so by actively inquiring about your progress, you’ll be able to take any action that is required as early as possible.

Many claimants find it much easier to ask their superannuation lawyer to reach out to the insurer because they have a greater understanding of the industry and the technicalities of the claims process. This allows you to have a clear and simplified understanding of exactly how your claim is progressing, rather than simply waiting for an update from the insurer.

Step 7: Navigate the Dispute Process if Denied

When you submit a superannuation claim, there’s always a chance that it will be denied initially. However, that doesn’t mark the end of the process, because you always have the opportunity to dispute an outcome if you feel the decision is incorrect. If you receive a negative outcome and would like to contest it, there are a number of steps that you can take to ensure your defence is well-presented and meets all the criteria.

However, like much of the process, this is always simpler when completed under the guidance of an experienced legal professional who has completed the dispute process many times before. They can guide you through the process and communicate effectively with the insurer to address the most important elements of your case and reiterate your points clearly and concisely, bringing you a step closer to a positive outcome.

Ready To Submit Your Superannuation Claim?

By carefully following each of these tips and closely following this superannuation checklist, you’ll be able to present a good case that is more likely to receive a positive result following an assessment from the insurer. Experienced superannuation lawyers can help you throughout each step of the process, giving you personalised advice and guiding you towards a positive result. If you’re ready to submit a superannuation claim, don’t hesitate to contact expert superannuation lawyers for individualised guidance today.