Are you making the most of your superannuation and TPD benefits in Australia? Many people may not realise the full extent of their entitlements and may be missing out on valuable financial support.

Superannuation and TPD (Total and Permanent Disability) benefits can provide crucial financial assistance in the event of serious illness or injury. However, navigating the complex Australian superannuation and TPD system can be challenging without expert advice.

In this article, we will explore the ins and outs of superannuation and TPD benefits in Australia, as well as provide advice from legal experts on how to maximise your entitlements. We will cover key topics such as TPD payout tax, non-preserved super, and the meaning of TPD. So, whether you are a seasoned investor or just starting out, read on to discover everything you need to know about TPD and superannuation in Australia.

Superannuation & TPD Explained

Superannuation and Total and Permanent Disability (TPD) insurance can be complex concepts to understand, but they are crucial for securing your financial future. So, what exactly do these terms mean, and how are they linked?

Superannuation is a retirement savings plan that is mandatory for all Australian workers, designed to provide income after retirement. On the other hand, TPD insurance is a type of insurance that provides financial support in the event of a permanent disability that prevents you from working.

TPD insurance is often purchased through superannuation funds, as it is a convenient and cost-effective way to obtain coverage. In fact, many superannuation funds automatically include TPD insurance in their policies.

But what happens if you make a claim on your TPD insurance? Is the payout taxable? The answer depends on whether the money comes from your preserved or non-preserved super. If it’s from a preserved super, the payout will be taxed as a lump sum, while non-preserved super will not be taxed. To learn more about how to maximise your superannuation and TPD benefits, it’s important to seek advice from legal experts who specialize in these areas.

Claiming TPD Benefits

When it comes to maximising your superannuation and TPD benefits, it’s important to have a good understanding of the criteria for claiming and the eligibility requirements. TPD benefits are a crucial part of any superannuation plan, as they can provide financial support for those who are unable to work due to injury or illness.

To be eligible for a TPD claim, you generally need to demonstrate that you are unable to work in your usual occupation or any other occupation that you are reasonably suited to. This assessment will take into account your age, qualifications, and experience. Documentation is also key when it comes to making a TPD claim, and you may need to provide medical evidence to support your claim.

By seeking advice from legal experts, you can ensure that you understand your rights and are able to maximise your TPD benefits while minimising any potential tax implications.

TPD Payout Process

If you are looking to maximise your superannuation and TPD (Total and Permanent Disability) benefits, it is crucial to understand the TPD payout process. The first step in the process is to determine your eligibility for a TPD payout from your Australian super fund. You can do this by checking the terms and conditions of your superannuation policy, which should outline the criteria for a TPD payout.

If you meet the eligibility requirements, you can then begin the process of making a claim for your TPD payout. This typically involves completing an application form and submitting relevant medical and financial information to your super fund. The fund will then assess your claim and determine whether you are entitled to a payout.

It is essential to seek professional advice when making a TPD claim. Legal experts can guide you through the process and help ensure that your claim is strong and valid. They can also advise you on whether your TPD payout will be taxable and if so, how much tax you may need to pay. Additionally, they can assist you in understanding the implications of accessing non-preserved superannuation funds to cover any costs associated with your TPD claim.

It is worth noting that the tax on a TPD payout can vary depending on your circumstances. Generally, if your TPD payout is paid as a lump sum, it may be taxable. However, if it is paid as a regular income stream, it may be tax-free. Legal experts can provide tailored advice based on your specific circumstances and help you understand the tax implications of your TPD payout.

Tax Implications

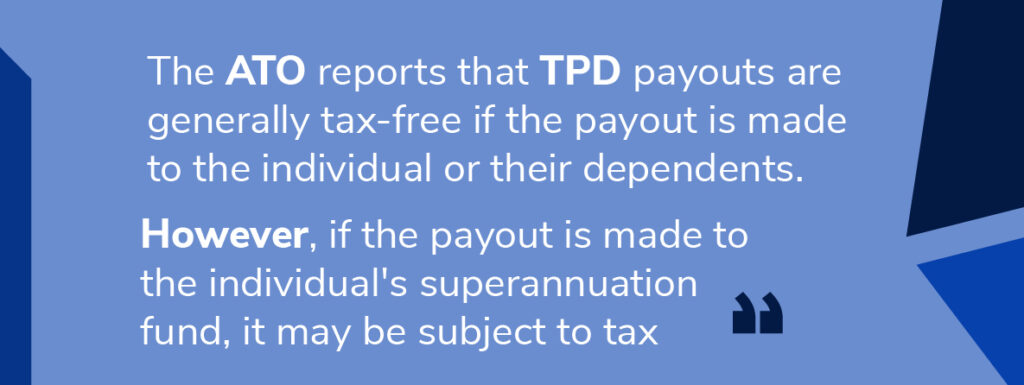

In Australia, TPD payouts from superannuation funds are subject to tax laws that vary depending on the individual’s circumstances. Generally speaking, TPD payouts from superannuation funds are tax-free if the individual is permanently and totally disabled and meets certain criteria. However, if the individual is not permanently and totally disabled, or if they receive the payout as a lump sum rather than as an income stream, the payout may be subject to taxation.

Strategies To Maximise Your Benefits

Contribute More To Your Superannuation Account

By making additional contributions, you can boost your balance and increase your potential TPD payout. You can do this through salary sacrificing or making voluntary contributions, such as after-tax contributions or contributions from your spouse. It’s important to note that there are limits on how much you can contribute to your superannuation each year, so it’s important to seek professional advice before making any large contributions.

Consolidate Your Super Accounts

If you have multiple super accounts, it can be challenging to keep track of your funds and ensure you’re not missing out on any TPD benefits. By consolidating your accounts, you can streamline your finances and potentially save on fees. This can also make it easier to manage your superannuation and ensure you’re maximising your TPD benefits.

Regularly Review Your Superannuation Account

Ensure you are regularly checking your super account to make sure it’s performing well. This includes checking the investment options, fees, and insurance policies. By making sure your superannuation account is well-managed, you can increase your potential TPD payout and ensure your funds are working hard for you.

Seek Advice From Legal & Financial Experts

When it comes to maximising your superannuation and TPD benefits, seeking advice from legal and financial experts can be invaluable. These experts can provide guidance on the best strategies for your individual circumstances and help you navigate the complex world of superannuation and TPD. They can also assist with ensuring you’re meeting all the necessary requirements to access your superannuation and TPD benefits.