When dealing with Total and Permanent Disability (TPD) claims in Australia it’s important to understand the depth of your entitlements, and to seek help in successfully manoeuvring the intricacies of the legalities. TPD claims offer assistance to individuals facing an inability to work due to a disability. Yet these claims can pose difficulties when tackled solo. In this piece we’ll delve into the significance of using a TPD claim attorney in protecting your rights and guaranteeing you obtain the aid you’re entitled to receive.

What Are Common Types of TPD Claims?

TPD claims can arise from various circumstances, including workplace injuries, medical conditions, or accidents. Common types of TPD claims may involve disputes over eligibility, assessment of disability, or challenges in obtaining adequate compensation.

Lawyers specialising in TPD claims have the expertise to assess the validity of your claim, gather necessary evidence, and advocate on your behalf to secure the benefits you’re entitled to.

How Can TPD Lawyers Assist in Claim Resolution?

TPD lawyers offer support during the process of resolving claims. Starting from the application phase, to appeals these experts walk you through every stage guaranteeing the protection of your rights. They communicate with insurance companies, healthcare providers and other pertinent individuals to construct an argument for your claim. Whether it’s through discussions, mediation or legal action TPD lawyers utilise their knowledge to enhance the likelihood of a result.

What Legal Issues Surround TPD Claims in Australia?

Navigating the legal landscape of TPD claims requires a comprehensive understanding of relevant laws and regulations. From workers compensation provisions to insurance policies, TPD claims involve intricate legal considerations. TPD lawyers possess the knowledge and experience to interpret these laws, ensuring your claim is pursued effectively and in compliance with legal requirements.

Here are some key legal aspects associated with TPD claims in Australia;

1. Defining TPD: The interpretation of TPD can vary significantly across insurance policies and superannuation funds leading to confusion and disagreements regarding whether an individual meets the requirements to be classified as totally and permanently disabled.

2. Supporting Evidence: Claimants are required to provide evidence to bolster their claim. Insurers may challenge the severity and impacts of a condition if there are delays in submitting the claim or if the medical evidence is deemed insufficient.

3. Policy Restrictions and Boundaries: TPD policies often include exclusions and limitations that could impact an applicant’s entitlement to compensation. For instance certain policies might not cover existing conditions or may impose particular work history prerequisites.

4. Claims Evaluation Procedure: The assessment process for TPD claims can be intricate, with insurers examining every facet of a case in an attempt to potentially decrease their financial obligations, for payouts. This situation could cause delays and denials of claims.

5. Denied Claims and Appeals: A considerable number of Total and Permanent Disability (TPD) claims face rejection each year in Australia. Claimants have the option to challenge these decisions through reviews, by the insurer lodging complaints with the Australian Financial Complaints Authority (AFCA) or pursuing action in court.

6. Claims Involving Mental Health: Claims linked to health conditions often encounter higher rejection rates. Demonstrating that a mental health issue has permanently hindered a claimant from working can be particularly difficult due to the subjective nature of these conditions.

7. Legal Assistance: Manoeuvring through the TPD claims process can be overwhelming for individuals lacking knowledge. Lawyers specialising in TPD claims can offer support though.

8. Modifications in Policy Definitions: Over time there have been revisions to the definitions and terms of TPD policies, which can influence claim success rates. There is a discussion about standardised terms to prevent insurers from employing restrictive definitions.

9. Benefit Payments: There is also a discussion regarding whether TPD benefits should be disbursed as a lump sum or in instalments. Some people believe that making payments in instalments can negatively impact individuals by exposing them to evaluations and unpredictability.

10. Deadlines: There are deadlines for submitting TPD claims and appeals. Failing to meet these deadlines may lead to the rejection of a claim.

How Do You File a TPD Claim?

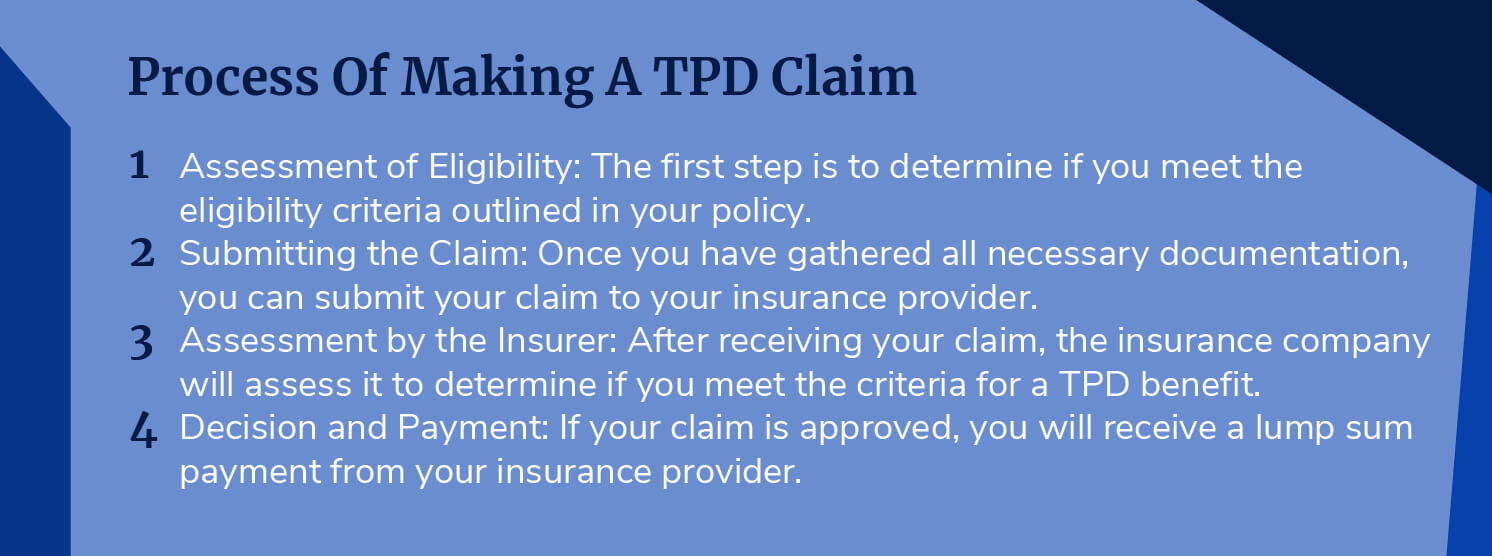

Filing a TPD claim involves adhering to specific procedures and requirements outlined by insurance policies and regulatory bodies. TPD lawyers can assist you in completing the necessary paperwork, gathering supporting documentation, and submitting your claim within prescribed timelines. They can also provide guidance on appealing unfavourable decisions or resolving disputes that may arise during the claims process.

What Are the Benefits of Seeking Legal Advice for TPD Claims?

Hiring a TPD lawyer comes with numerous advantages for those making claims. These experts grasp the intricacies of TPD claims. Can offer guidance tailored to your specific situation. When you rely on a TPD lawyer for your claim you tap into their knowledge and support improving the chances of a good result. Whether it’s optimising your benefits or manoeuvring through legal obstacles, TPD lawyers act in safeguarding your rights during the claims journey.

TPD claims in Australia present unique challenges that require specialised legal expertise to navigate effectively. By seeking assistance from experienced TPD lawyers, claimants can ensure their interests are protected and receive the support they need to move forward. Whether you’re facing obstacles in filing a claim or encountering difficulties in securing compensation, TPD lawyers are invaluable allies.

Reach Out To Our TPD Claim Solicitors Today!

McDonnell Schroder’s highly qualified superannuation lawyers and TPD claim solicitors have assisted Sydney residents for over 50 years. Ensuring your future through superannuation and Total and Permanent Disability (TPD) claims is more important, than ever.

McDonnell Schroder, delivers comprehensive legal services leading the way in helping individuals navigate the complexities of superannuation and TPD claims. Whether you’re encountering difficulties with your superannuation fund or pursuing compensation through TPD claims McDonnell Schroder’s expertise in this area is unparalleled. If you’re seeking guidance and assistance regarding superannuation and TPD claims, McDonnell Schroder is your go to choice. Reach out to us today and gain peace of mind knowing your affairs are in the best hands possible. Let’s safeguard your future together.