Being involved in a car accident can make for a harrowing experience. The sound of screeching tires and the rush of adrenaline can cause great distress. Once the dust settles, one question often lingers in our minds: how long after an accident can you claim insurance?

We don’t all understand the ins and outs of car accident claims, but that’s why our team of insurance claim experts have compiled this article to simplify the process and answer all the questions you might have in this difficult time. Hopefully, once you’ve finished this article, you’ll have a clearer idea of your next steps, and you’ll have the knowledge you need to present a well-supported claim.

When Are You Eligible To Make A Car Accident Claim?

Eligibility for making a car accident claim largely depends on the circumstances surrounding the incident. If your vehicle was involved in a collision that caused damage to property, your own car, or another driver’s car, you are entitled to lodge a claim. The specifics may vary based on your insurance policy and the nature of the accident, but in these situations, a claim is applicable.

Comprehensive car insurance is typically the most thorough level of coverage you can have, but it’s essential to review your policy to understand the extent of your protection. Be sure to check the relevant product disclosure statement for your policy too, because the amount of time you have to submit a claim can differ between insurers. Insurance lawyers can assist you in this process, review your policy, and provide personalised guidance to help you receive the compensation you’re entitled to.

When Are You Eligible To Make A CTP Claim?

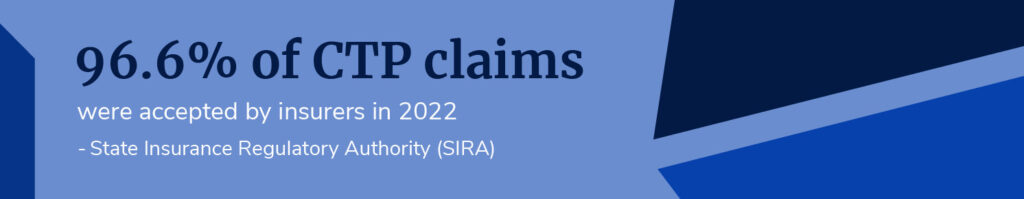

Compulsory Third Party insurance (CTP insurance) serves a distinctly different purpose than traditional forms of car insurance. Instead of simply covering property damage and vehicle repairs, CTP insurance primarily focuses on compensating individuals who have been injured or killed in a car accident.

This form of insurance is mandatory for drivers in all Australian states and territories. For drivers in NSW, SA, or QLD, CTP cover must be secured before registering your vehicle. In other states and territories, CTP insurance is typically included in the vehicle registration.

Eligibility for making a CTP claim depends on the circumstances of the accident and the resulting injuries. If you or someone you know has been injured in a car accident, it’s crucial to understand the specific criteria and time limits for CTP claims in your state or territory. Keep in mind that these timeframes can vary, so it’s advisable to consult your local insurance regulatory authority for precise information regarding the submission of CTP claims in your area.

How Long After The Accident Should I Submit A CTP Claim?

The timing for submitting a CTP (Compulsory Third Party) claim varies from state to state, and it’s crucial to be aware of the specific deadlines in your region:

In New South Wales, you have a window of three months to submit your CTP claim following an accident. It’s important to note that if you delay beyond 28 days from the accident date, you may risk losing backpay entitlements, making prompt action critical.

In Tasmania, you have a more extended timeframe of up to one year to submit an ‘Application for benefits’ (Form B) to receive entitlements from CTP insurance.

South Australia imposes a six-month limit for CTP claims, but exceptions exist, especially when the other party’s vehicle cannot be identified.

For drivers in Western Australia, CTP claims can be submitted up to three years from the date of the accident. However, it is strongly recommended to act as soon as possible to ensure a smoother process.

In the Northern Territory, CTP claims must be submitted within six months of the accident.

In the Australian Capital Territory, the timeframe for submitting a CTP claim varies depending on whether you have enlisted legal help. With legal assistance, it must be done within one month of the accident, while without it, you have three months through the nominal defendant.

What Should I Include In My Application?

When you’re preparing your application for a CTP claim, it’s essential to compile all the necessary documents and evidence to support your case effectively. Each of these pieces of evidence will give you the best possible chance of securing the compensation you’re entitled to.

Photographs: If possible, provide any clear images of the accident scene, the vehicles involved, and any visible injuries. These visual records can provide crucial evidence of the circumstances.

Police Reports: If the police were called to the scene, obtain a copy of the accident report. This official document can serve as an objective account of what happened.

Medical Records: Include detailed medical records documenting your injuries, treatments, and prognosis. This substantiates the extent of your injuries and their impact on your life.

Witness Statements: If there were witnesses to the accident, gather their statements. Witness accounts can provide independent perspectives on the incident.

Income Records: If your injuries have affected your ability to work, provide records of your income and employment history. This information is crucial for calculating lost income claims.

Expense Receipts: Keep track of all accident-related expenses, such as medical bills, prescription costs, and rehabilitation expenses.

While gathering these documents is vital, consulting with experienced insurance lawyers can significantly enhance your chances of a successful claim. They can guide you through the process, ensure you have all the necessary evidence, and navigate the legal complexities to maximise your entitlements. Remember that a well-prepared and comprehensive application is the key to securing the compensation you deserve.

Prepare A Quality CTP Claim Application With The Experts

In the aftermath of a car accident, it’s important to follow all best practices in submitting a CTP claim. Timely action and a well-documented application make a significant difference in securing the support you need. This complex process is best when guided by an experienced insurance lawyer with the expertise necessary to present a strong claim and support you through a difficult period. Don’t hesitate to reach out to a reputable insurance lawyer today to ensure your CTP claim is handled with the care and attention it deserves.